We don’t budget! You don’t hear that often in the personal finance community but hear us out. Like we said in Know your Numbers, it’s important to know where you want to go with your money and it’s important to know where you are today so you can figure out how to get there.

That’s what paying yourself first is. Instead of budgeting every dollar, figure out how much you can pay yourself every month – i.e. save & invest so you can build wealth. Make it a priority to pay yourself first so the first thing you do every month is build your own wealth.

Here are two reasons why this matters:

- The effects of small habits compound over time. Andddd… compounding is how you build wealth.

- Knowing that you took care of you first every month is self care – it’s how we remove money anxiety & keep living our thriving life.

Small habits compound over time and… compounding is how you build wealth

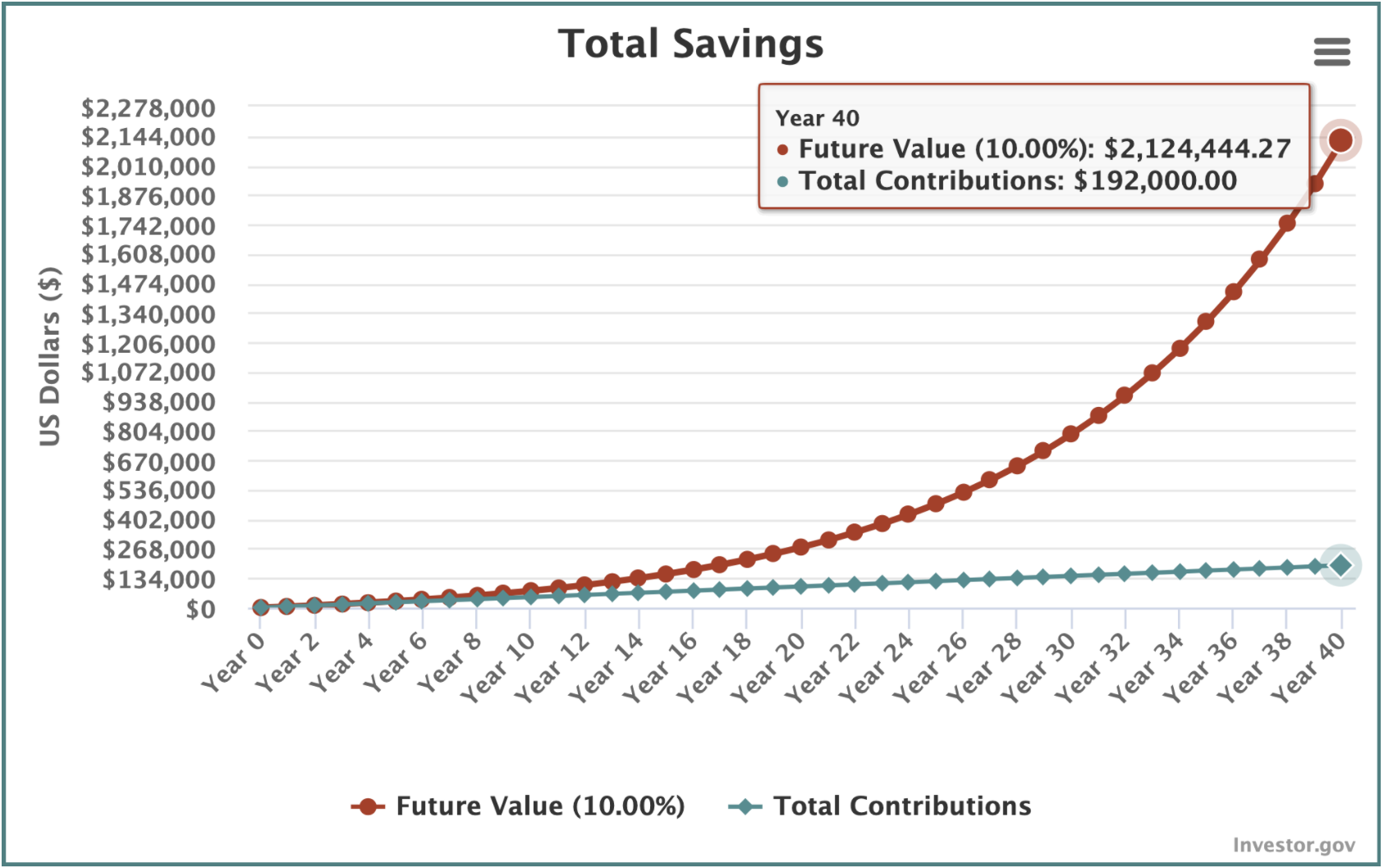

If you can invest $100/week starting today and keep doing it for 40 years, you may wind up with $2,124,444. You read that right, that’s well over 2 MILLION dollars 🤯!

We are making a few assumptions here, mainly that you can get an average of 10% annual return over 40 years. But it’s not a wild assumption, considering the S&P 500’s* average return since it started has been 10-11%!

*S&P 500 is an index (think basket) of the 500 largest publicly traded companies in the US.

We’ll leave you with this thought about compounding: what matters is just to start. And then continue. Even if you’ve only got $50. Or you are “already” 20, 30, 40, 50 years old…, just start so you can give yourself the most time for your money to earn money for you. Like Einstein said, compounding is the “eighth wonder of the world.” It’s how your money earns money even when you’re sleeping, or working, or relaxing.

You can play around with your numbers here & make your own version of the chart above.

Financial self care – take care of you first (& automate it!)

That feeling of wanting to do “better” with your money? Or feeling like a mess with a bank account? That feeling is stressful and unwanted. So we practice our self care by handling it first every month. We even automate it so you don’t actually have to do ANYTHING. That’s what building wealth like a badass is about – you feel good about money & you make it simple!

Are you bought in yet?! 😉

So what do you actually do?

- Find your Pay Yourself First number. Put your numbers into our wealth tracker template and play around until you get to a number in line 15 that feels workable for you and makes you happy. That’s your Pay Yourself First number! 🎉

- Schedule an automatic transfer of this number from your checking to your savings & investment accounts every month. Technology is sometimes wonderful and can take all the work out of things.

- For example: I get my paycheck on the 15th and 30th of every month. Then my checking account automatically transfers ½ of my Pay Yourself First number to my High-Yield Savings Account on the 17th and 2nd of every month.

- Toast to being awesome with your money and spend guilt-free on what you enjoy with the rest! And you did it all without having to track every dollar every month in a budget!

→ You paid yourself first! Now let’s put that money to work for you by investing to build wealth.

Sign up below to get access to our wealth tracker template!

Comments are closed