Note: invest at your own discretion. The information we share below is for educational purposes and based on our own experience and investing decisions. Any financial decisions you make are your own.

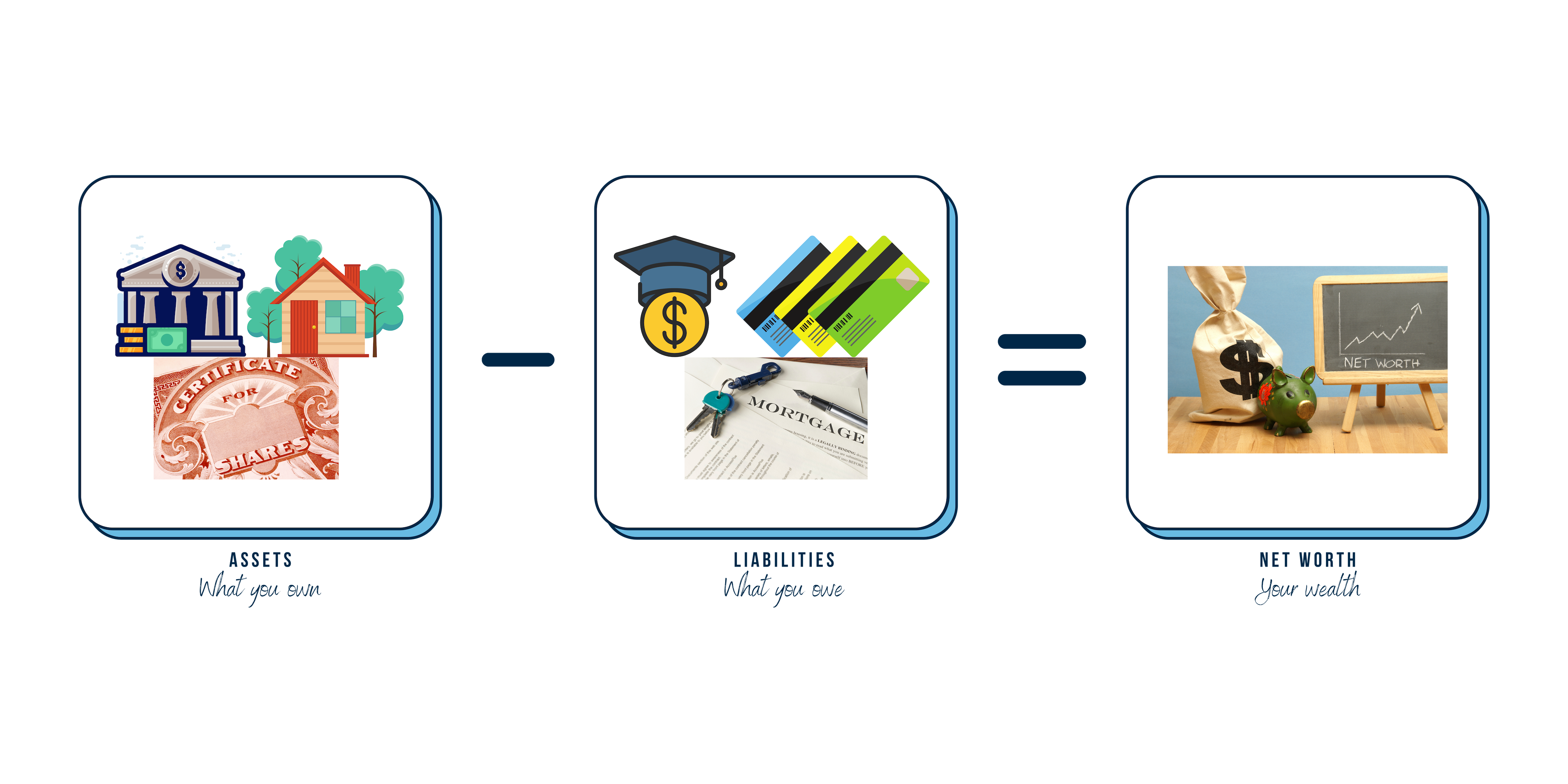

Now that you’re paying yourself first, let’s make sure that money is working for you! There’s two parts of building your wealth (your net worth) and we’re going to get you set up for both.

- Assets: what you own that’s putting money in your pocket

- Liabilities: what you owe that is taking money out of your pocket

Assets

Assets are anything from your checking & savings accounts, stocks, real estate, crypto, businesses, pokemon trading card collection, etc… Anything that earns you money and builds you wealth.

Once you have your income and you’re putting your Pay Yourself First amount into your high-yield savings account every month, how do you get this money working for you?

Let’s talk about two options:

- Keeping that money in a savings account. This will earn you some interest, but leaves you with inflation risk (your money won’t be worth as much tomorrow as it is today).

- Assuming you start with $0, put in $1,000 every month, and assume a minimal return given low savings rate – inflation, you will end up saving around $500k in 40 years. As you can see though, this only gets you about as much as you put in.

- Investing!

- Assuming you start with $0, put in $1,000 every month, and assume a 10% annual return, you will end up with almost $5.5 million in 40 years!

- We’re basing this scenario off of a low-cost index fund investing approach. Historically, the U.S. total market index funds like VTSAX, VTI, or SPY have returned ~10% annual returns on average.

- We use the low-cost index fund investing approach because it offers decent (& consistent) returns over a long-term horizon, with the lowest effort to manage our investments. However, there are other approaches to investing and the important thing to do is to match your approach & desired returns to your appetite for risk.

That is the power of putting your money to work for you.

Here are some rules of thumb that we use for our money:

- Before you start investing, make sure you have built up your emergency fund. We recommend keeping 3-6 months of your critical expenses (cannot live without these every month) in a high-yield savings account. Then don’t touch this except for emergencies or surprise large expenses.

- Put the rest of your savings and monthly contributions into long-term investments.

- Our approach is this:

- Only invest money we don’t need for at least 2-3 years. That way if the market drops, you have time to recover and don’t have to pull your money out and “realize” that loss.

- Invest for a long-term time horizon (10-40+ years). The market does not guarantee anything. However, it has gone up fairly consistently if you look at it over a 30 year (long-term) horizon.

- Invest in low-cost index funds that track the broad US market or sectors of the market, like high-growth technology, ecommerce, large cap stocks, etc… This let’s you track the performance of the entire market without having to become deeply aware of each company and be able to pick the exact right ones.

- Invest consistently. The power of the investing graph above comes from putting your money to work consistently so it can compound consistently.

The most important thing is to start. Start putting your money to work for you so you can benefit from compounding over time.

Liabilities (aka debt)

There’s so much to say about debt . And so many feelings wrapped up in debt.

The biggest tl;dr we can offer is that the power of compounding works in both directions. As Einstein said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

- With assets, money compounds so you make money on the money you just made.

- With debt, you owe money on the money you owed because you owed money 🤯. Wacky right?

Let’s talk about how debt works:

Say you have a credit card balance of $10,000 (your principal balance) with an interest rate of 20%. If you decide to pay this off over 5 years, you will end up paying an extra $5,896 for the right to have borrowed $10,000.

Source: https://www.bankrate.com/calculators/credit-cards/credit-card-payoff-calculator.aspx

The same thing applies to any debt you have like credit cards, student loans, mortgage, etc… When you owe money, you are accumulating interest on that debt, which increases the total amount you have to pay back. And every payment you make goes towards interest first and then the principal, which is why it’s so important to make sure you are paying off enough every month to actually decrease your principal balance. That’s the only way you will be able to pay it off to 0 instead of accumulating more debt on the same original balance.

This is one of the biggest reasons we want to see personal finance taught in schools, or at least college. So many of us start our earning lives without knowing the details of how our finances can work for us or how they can dig us into a deep hole we have to then dig ourselves out of. I cannot imagine a more useful general education requirement for us all to have before we graduate. But until we can make that happen, we’ve got your back!

We started this post talking about the two parts to building wealth: your assets & your liabilities. So how do you manage both?

There’s a lot of opinions on this and we will share the ones we’re aware of along with our thoughts on them so you can make the best decision for yourself.

| The OPINION | Our thoughts |

| All debt is bad! There’s folks (aka Dave Ramsey) who advise you to NEVER use a credit card or get into any debt at all. | We disagree. Firstly, there’s a lot of shame wrapped up in this guidance. No matter where you are today, you can build wealth by making the right plan. No shame required. You should use credit cards to your advantage, by paying them off in full every month. We put all of our spending on credit cards, but we only spend what we would have if we were paying in cash and know that we can pay off every month. With this approach, you don’t get into credit card debt and you earn rewards. Some debt is good because it lets you leverage money to do big things you may not be able to do in cash. Like buying a rental property, a home, a business, etc… The important thing here is to get a low rate and pay it off consistently every month. |

| Invest while you pay off debt. | It depends. There’s a lot of recent dialogue saying you shouldn’t wait to invest until you’ve paid off debt because building this habit matters. While we agree that a consistent investing habit is important, considering the interest rate on your debt is important as well. If you’re earning 10% long-term by investing, but you’re paying 20% (average CC APR) on your credit card debt, you are losing more money than you might be earning. With high interest debt (8%+) like credit card debt, our personal approach would be to pay that off as quickly as possible before you start investing. However, it is a personal decision and if there’s an approach that motivates you more, you should take that into account. With lower interest debt like mortgages, auto loans, and in some cases, student loans, as long as you’re making consistent monthly payments to pay this down, you should definitely invest at the same time so you can start compounding in your favor. |

| Using the snowball method to pay off debt. | Snowball method: pay all minimum balances every month + allocate remaining funds to pay off smallest balances first. Avalanche method: pay all minimum balances every month + allocate remaining funds to pay off highest interest rate balances first. We personally prefer the avalanche method because it allows you to pay off debt faster and by paying less total interest. However, if paying the smaller balances first is what will be more motivating to you to make the monthly payments, definitely do that. |

Long story short (yea yea we know, we made you read this WHOLE long story first), building wealth means increasing your assets by making your money work for you, while decreasing your liabilities by paying off debt. And the best way to measure your progress towards building wealth is to track your net worth every month.

Comments are closed